If there’s one thing that is guaranteed for all business owners it’s that you WILL exit your business. This will usually either be through selling the business, winding it up, or passing it over to family for you to retire. Either way you will exit at some point in the future. It’s important to ensure that the future value of your business is where it needs to be to give you what you need when you retire.

In my previous blog I talked about the danger of being a lifestyle business owner. Essentially focusing too much on current income and too little on the future value of the business. This subject is so important to all SME business owners, that I think it needs another discussion.

Planning For The Future Is Important

I’m currently working with 5 business owners who are planning their future exit from their business. It’s fair to say they have been moving from being a lifestyle business owner to having a business asset that will fund their future. None of them are going to the market yet. But, they are all very focused on increasing the value of the business and making it run without them. Then they have more options.

Present Wants Vs Future Needs

Business owners need to balance what they want today with what they need in the future. Too many focus on income, which is usually looking at the “present wants” and not enough focus on value growth, which is a look into the “future needs”.

The income replacement value of the business is the value you need the business to be worth when you exit to maintain your current standard of living after you exit.

When business owners think about the personal value they get from the business, they often just look at salary, bonus and dividend. But there are many other benefits they run through the business. Such as health insurance, life insurance, company paid car, travel and meals, rent, share options, etc., that should be considered when determining the income replacement value.

Remember, when you are no longer running the business, you need to find other ways to fund these additional benefits. You can’t run them through the business anymore. A business owner taking a £50,000 salary may also be getting another £50,000 in benefits.

Three out of four business owners have less than £400,000 saved in their retirement accounts 1. That means business owners are underestimating their financial reliance on the business post-retirement. Many may be forced to rely on the proceeds from the sale of the business or continue to receive income from the business to fund their retirements. This lack of financial independence may also lead to a business owner never truly exiting the business. Consider that 70% of business owners have not set any retirement date.

Income Replacement Value

To determine the income replacement value of the business, add up the cost of all these benefits, plus salary, bonus and dividend, and divide it by a withdrawal rate you are comfortable with (typically between 3-5%). Through this exercise, business owners often realise that the income replacement value is higher than what they think they could get for the business if they were to sell it.

The difference between the income replacement value and the value you could sell the business for today is your retirement income gap. That gap can be reduced by either determining ways to increase the value of your business (making it more sellable) or by having other assets outside your business to fund the gap. The reality is it will probably be a combination of both.

Why Don’t Business Owners Leave?

Consider the following graphic. The truth for you may lie somewhere in between:

Business owners say they don’t have an exit strategy because they still enjoy running the company 2

Business owners would exit today if their financial security were assured 3

So, is this what is going around in your head?

“I’ve no plans to exit, it’s probably not market-ready. Yet, I would sell if I could keep my lifestyle or have financial security”.

Will Your Business Sell?

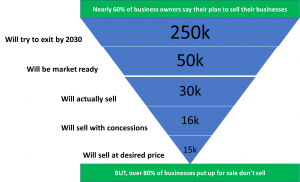

Bear in mind, most businesses are not sold. Consider the following research data 4:

Income From The Business Post-Retirement

Returning to the 5 businesses I referred to at the start, they are all keen to have more valuable businesses and keep their options open. One option at least 3 of them are considering is continuing to receive income in the business post-retirement. As so many business owners do.

If that is the route you are open to, it’s critical to document your roles and responsibility with the new management team upfront so as to make clear with everyone your involvement going forward.

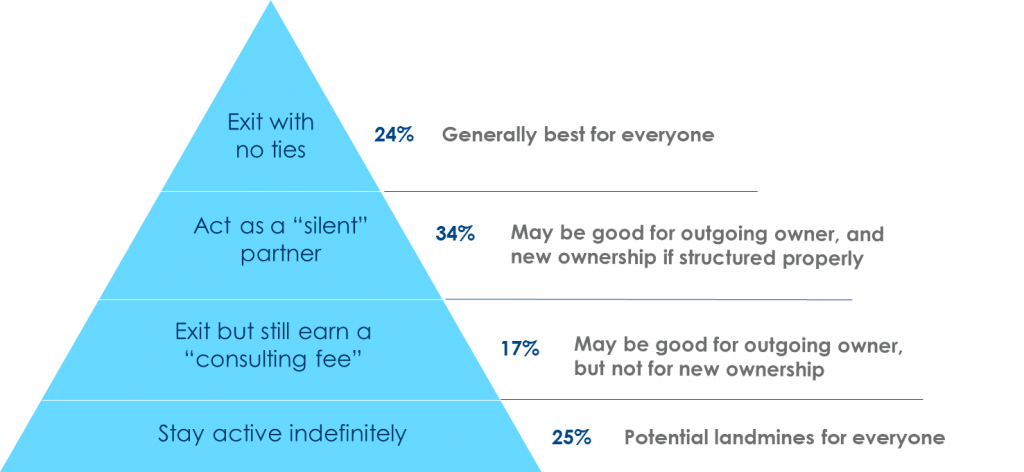

Obviously exiting the business with no-ties (financial or otherwise) is often the best course of action for everyone.

However, it might make sense for business owners to exit or transition ownership of the business gradually. Assume more of a silent partner role and earn a salary commensurate with that involvement. This works if your successor is still learning the ropes and will look to rely on your expertise as they grow into the leadership role. The key here is to make sure there is a firm timeline in place for when you will be completely removed from the business—from both a responsibility and financial perspective. This arrangement, and the compensation associated with it, should not be in perpetuity.

Instead of calling it a salary, business owners often call the compensation they receive from the business in retirement a “consulting fee”. Typically, these business owners are not contributing much in the way of growing the business. They are simply staying on the payroll and maybe occasionally “showing up at the office”. While this arrangement may be good for the retired owner, it is often not in the best interest of the new leadership. If you are planning on receiving a “consulting fee” be sure to document what your roles will be. Agree on compensation equal to the value you are bringing back to the business. Otherwise you may find the business can’t, or won’t, support it in the future.

Hierarchy Of Future Involvement

Staying active in the business post-retirement can create potential landmines for everyone. It means that you as the owner never truly let go of the business. You never really let the next ownership group take over. This could involve you passing on the ownership, but always being around. Also, never giving the new team the autonomy to do things their own way. Or maybe you let them assume the leadership responsibilities, but don’t give them any of the ownership. Either way this is not an ideal strategy for the long-term success of the business or for a happy and comfortable retirement.

Consider this owner’s hierarchy of future involvement:

In this discussion I have referred to the balance between meeting your present lifestyle wants and your future value needs. Everyone will have their own balancing point and thinking about the income replacement value is important.

Equally, most business owners don’t have an exit plan and need to keep working to maintain or improve their lifestyle. But, one statistic is certain: 100% of all owners will exit their business!

Staying involved in the business, maybe transitioning out of leadership first then ownership later, can be attractive to some. Though the new leaders and owners are likely to be less keen.

You will probably not have answers to these things. You may think you are too young to be thinking like that. One solid piece of advice I can leave you with is that it’s never too early to start working on your business to make it run without you. That way, you’ll keep your options open. You’ll also have a more valuable business for that better lifestyle and the richer future.

So if you have now realised that you need to make your business more valuable but not sure what you need to do a good first step would be to take the Value Builder Assessment. It’s free, takes approx 13 minutes and gives you an instant score. It could be just what you need to start putting things in place to make your business more valuable ready for your exit.

Get your Value Builder Score now

1Source: Mass Mutual Business Owner Perspectives study 2018

2Source: Wilmington Trust, The Power of Planning, 2017

3Source: BEI Business Owner Survey 2016

4Source: Mass Mutual Business Owner Perspectives study 2018